Profitable

Easy and fast solutions at your fingertips. Apply from anywhere, with just one document required

Easy and fast solutions at your fingertips. Apply from anywhere, with just one document required

A direct lender committed to responsibility and innovation. We keep your data confidential and help in hard times

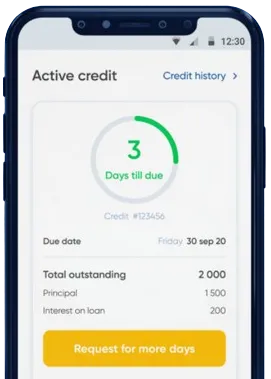

Straightforward solutions in just minutes from home. Money is transferred instantly; extend loans as needed

Apply conveniently via our app with a straightforward form.

Expect a decision in as little as 15 minutes.

Access your funds; the process usually takes just a minute.

Apply conveniently via our app with a straightforward form.

Download loan app

When unexpected expenses arise, many South Africans may find themselves in need of quick and efficient financial assistance. In such situations, same day loans online can be a lifesaver. These types of loans offer fast approval and funding, making them an ideal option for those in urgent need of cash.

Same day loans online are designed to provide borrowers with immediate access to funds on the same day of application. This can be especially helpful for individuals facing emergency situations or unforeseen expenses that cannot wait until their next paycheck.

There are several benefits to taking out a same day loan online in South Africa:

Speed: One of the most significant advantages of same day loans online is their quick approval process. Borrowers can receive funds in their bank account within hours of applying, providing much-needed financial relief in a timely manner.

Convenience: With same day loans online, borrowers can apply for a loan from the comfort of their own home. This eliminates the need to visit a physical branch or wait in long lines, saving valuable time and energy.

Flexibility: Same day loans online offer flexibility in terms of loan amounts and repayment terms. Borrowers can choose a loan amount that suits their needs and select a repayment schedule that aligns with their financial situation.

These benefits make same day loans online a popular choice for individuals seeking a quick and convenient financial solution in South Africa.

Applying for a same day loan online is a straightforward process that can be completed in a few simple steps:

Research and compare lenders: Before applying for a same day loan online, it is essential to research and compare various lenders to find the best terms and rates.

Fill out the online application: Once a lender has been selected, borrowers can fill out an online application form, providing personal and financial information.

Submit required documents: To complete the application process, borrowers may need to submit documents such as proof of income, identification, and bank statements.

While same day loans online can be a valuable financial tool, it is essential to consider the following factors before taking out a loan:

Interest rates and fees: Same day loans online may come with higher interest rates and fees compared to traditional bank loans. It is crucial to carefully review the terms and conditions of the loan to understand the total cost of borrowing.

Repayment schedule: Borrowers should ensure that they can comfortably repay the loan on time to avoid late fees and penalties. It is recommended to create a budget and plan for loan repayment to avoid financial strain.

Financial hardship: If borrowers anticipate facing financial hardship, they should avoid taking out a same day loan online and consider alternative options such as credit counseling or debt consolidation.

Same day loans online offer a convenient and efficient financial solution for individuals in need of quick cash in South Africa. With their speedy approval process, flexibility, and convenience, these loans can provide immediate relief during emergency situations. However, it is essential for borrowers to carefully consider the terms and conditions of the loan and ensure they can comfortably repay the borrowed amount on time. By understanding the benefits and considerations of same day loans online, borrowers can make informed financial decisions and effectively manage their finances.

Same day loans online are short-term loans that are typically approved and disbursed on the same day of application. These loans are usually used for emergencies or unexpected expenses.

When you apply for a same day loan online in South Africa, you fill out an online application form with your personal and financial information. The lender will then review your application and if approved, the funds will be transferred to your bank account on the same day.

The requirements vary among lenders, but generally, you need to be a South African citizen or permanent resident, have a steady income, be at least 18 years old, and have a valid bank account and contact information.

The loan amounts for same day loans online in South Africa usually range from R500 to R5000, but this can vary depending on the lender and your financial situation.

Interest rates and fees for same day loans online in South Africa are typically higher than traditional loans due to their convenience and quick approval process. It is important to carefully read and understand the terms and conditions before agreeing to the loan.

If you cannot repay your same day loan online on time, you may incur additional fees and interest, and it can also negatively impact your credit score. It is important to communicate with the lender if you are having trouble making payments to explore alternative options.